Are ECA Marcellus Trust Holders About To Get WHXed?

Disclosure: I am short ECT.

This article will explain why investors are set to lose over 50% of their money with ECA Marcellus Trust (ECT). The key points:

- ECT is only worth its $6.50 net asset value (currently 2.4x overvalued)

- ECT's dividend is about to get cut 30% in the upcoming quarter (which catches lots of holders off guard and revalues the stock much lower)

- Insiders just dumped a lot of stock (1.3mm shares)

- There is increased selling pressure coming now that insiders just swapped their shares to eager sellers

Overview

ECT is a royalty trust. Essentially unit holders own a claim on a cash flow stream from Marcellus gas wells (~52 producing wells). Since natural gas wells decline, unit holders get a declining dividend stream, which is essentially a return of capital (plus a small return). Unit holders are mainly retail investors in search of yield, who often forget that they are mainly getting a return on capital and often mistakenly think their dividend or yield is safe (and not declining). Even the WSJ has been trying to make investors aware of the risks of some royalty trusts. When investors realize their distributions aren't as safe or sustainable as they thought, royalty trusts sometimes have "oh sh!t" moments. For example,WHX crashed from $18 to $9 last summer. SDT is down 35% in a month and a half.

What is ECT really worth?

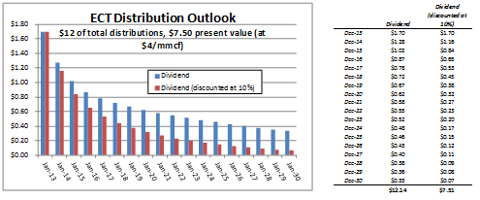

ECT's asset value, based on its year-end 2012 reserve report (filed an 8-K on 2/7/2013), values its claim on Marcellus wells at a present value (pv-10) of $79mm ($4.50/share). ECT has a market cap of $275mm ($15.70/share). That is a ridiculous disconnect. ECT has no new wells, there is no new production or upside, it is just a cashflow stream based on its declining production and natural gas prices. While the reserve report was run using $2.88/Mmcfe, and gas prices are ~$3.75/Mmcfe today, if the report was run assuming natural gas prices of $4/Mmcfe, 10% above today's prices, the present value would only be ~$130mm. That means if gas goes up 10% to $4/Mmcfe, ECT is still only worth $7.40/unit. At current gas prices, it's only worth $6.50/unit. There are much, much cheaper ways to get exposure to natural gas prices and get "income." Why pay $16 for something that will only pay out $6.50 worth of discounted dividends (which gets taxed!) before it dissolves essentially worthless in 2030?

Moreover, $6.50 is the value of the cashflow stream, but trust holders will soon have to pay an increasingly higher percentage of taxes on distributions down the road (as accelerated depletion/tax shielding runs out). This is why trusts should trade at or below their pv-10 value after activity is complete. ECT is 2.4x overvalued, but investors are wrongly valuing it off its current unsustainably high yield instead of realizing they are getting a return of capital. A return on capital that is about to start declining rather quickly - Marcellus wells can decline up to 50+% in year one.

Some investors have looked at book value for valuation help (thanks to you Forbes!) but that's also irrelevant for ECT:

The $352,100,000 reflected in the Statements of Assets, Liabilities and Trust Corpus as Royalty interests in gas properties represents 17,605,000 Trust units valued at $20.00 per unit. The carrying value of the Trust's investment in the Royalty Interests is not necessarily indicative of the fair value of such Royalty Interests.

ECT was worth $20 when it was sold initially to the public, but that was in June 2010 when gas prices were near $5/mmbtu. Now gas prices are 35% lower and the trust has paid out 37% of its reserves (thanks,Daniel), so the value is much, much lower. Even if gas prices rebound in 2-3 years, 75% of the value will have been distributed in a low gas price environment and the remaining reserves will only be worth a few dollars.

ECT annual distribution outlook at $4/mmcf = $7.50 net asset value (which will be even lower once tax shield rolls off)

What re-prices ECT to its net asset value? 30% dividend cut coming...

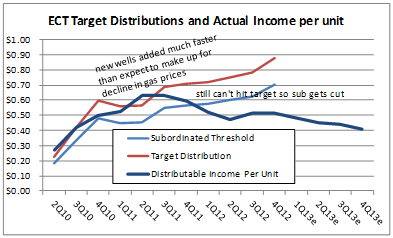

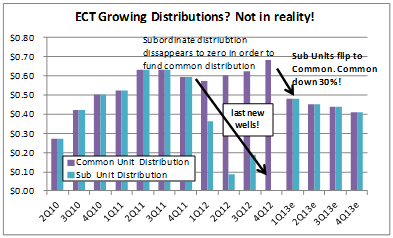

Like WHX, nothing changes until the "oh sh!t" moment. ECT's could be coming. Through 2012, ECT had 75% common units and 25% subordinated units (units that won't receive a distribution unless the trust makes enough money each quarter). It's the way the royalty trust was set up. The last few quarters ECT hasn't made enough to pay the subordinated holders (didn't meet the 'subordinated threshold') so all the money goes to the common unit holders. Retail investors haven't really cared about subordinated shortfall because they are getting their increasing distributions and they are happy. ECT's 3Q12 distribution of $0.624 jumped to $0.682 in 4Q12 thanks to increase in gas prices (and sub units getting nothing). Not bad. It looks like a 15% annualized yield. But in reality, income was just $0.51/unit. Again, ECT's distributions are mainly a return on capital, not a steady income stream, and it is currently worth $6.50. And it will be worth $6 after the <$0.50 May distribution.

So here's where it gets interesting. The 25% subordinated units flipped to common units at year-end 2012. Investors would know that if they read the 10-Q, but most don't. There are only 3 analysts that cover the trust, none has a favorable view. Moreover, the trust doesn't hold a conference call anymore (it just collects checks from producing gas). So the distribution that investors have been watching grow is about to get cut 30% in 1Q13 (announced in May). Why?

- 25% cut from the subordinated units flipping to common

- production will be down because all wells are now online and declining (decline is actually steepest in year one)

- gas prices are down in 1Q13 vs. 4Q12

- the positive basis differential will be down in 1Q13 vs. 4Q12

Call and ask ECA if you disagree with any of the above. The 30% decline in distributions likely catches most investors, who look at historical distributions and extrapolate forward, completely off guard, and the stock will crash.

ECT has badly missed target distributions and subordinated threshold, but investors' distributions have been going up, until now...

Disguised Insider Selling

It gets worse. The sponsor of the royalty trust, ECA, cleverly unloaded its position by swapping as much as it could of its ECT position (the subordinated units that are now common units) for NGT units (an expiring royalty trust). It's basically huge insider selling. And of course ECA would want to sell their position that's 2.4x overvalued. This doesn't impact ECT at all, other than free up 1.3mm shares of the float and put those ECT units in the hands of holders who are trying to monetize their remaining position of an expiring royalty trust. NGT doesn't trade and is set to receive a $20.95 breakup value in August 2013. ECA (the sponsor for ECT) gave NGT holders (who will collect $20.95 in August) a premium amount of their ECT shares now ($22.55 worth) in order to unload their position and to incentivize NGT holders to take it:

…such consideration represents a 7.6% premium to the anticipated cash value that each NGT Depositary Unitholder choosing not to tender would receive upon the termination of NGT…

This will likely result in selling pressure by NGT holders (who tendered 950k NGT units for 1.3mm ECT units) who couldn't get out previously and wanted to profit from getting ECT shares at a 7.6% discount.

Conclusion

Insiders are unloading, there will likely be increased selling pressure from new unit holders, ECT is 2.4x overvalued at current gas prices, and unit holders are about to see their dividend get cut 30% sequentially in early May. I'd hate to be holding this hot potato.

Additional disclosure: I put on a small short position after reading Daniel Moore's article and doing additional work. If you disagree with any of this analysis, talk to an analyst to fact check it. Unfortunately, ECT will eventually crash to its net asset value, just like WHX did. Royalty trusts are great income products and a great way to invest in commodities, but only when valued appropriately.

Keine Kommentare:

Kommentar veröffentlichen